GOV. BAKER EXPECTED TO SIGN RECENTLY APPROVED LODGING TAX BILL

Breaking news for homeowners on lodging tax legislation: In a surprising move, the MA House and Senate last night pushed through the lodging tax bill prior to the end of the informal legislative session on Jan. 1. See today’s Globe article .

The bill stipulates that any leases signed on or after January 1, 2019, for any rental occupancy after July 1, 2019, would be subject to the new taxes, making it imperative for you to sign as many leases prior to January 1 in order to save next summer’s tenants from having to pay the approximately 14.45% tax.

This process is likely to move very fast – within the next few days – so it’s important to act soon.

To express your thoughts and concerns to Governor Baker and/or Lt. Governor Karyn Polito, you can email them at https://www.mass.gov/forms/email-the-governors-office

Also consider sharing your thoughts by tagging them on Twitter:

Governor Baker’s Constituent Services Main Office: (617) 725-4005 Toll-free in Massachusetts (888) 870-7770

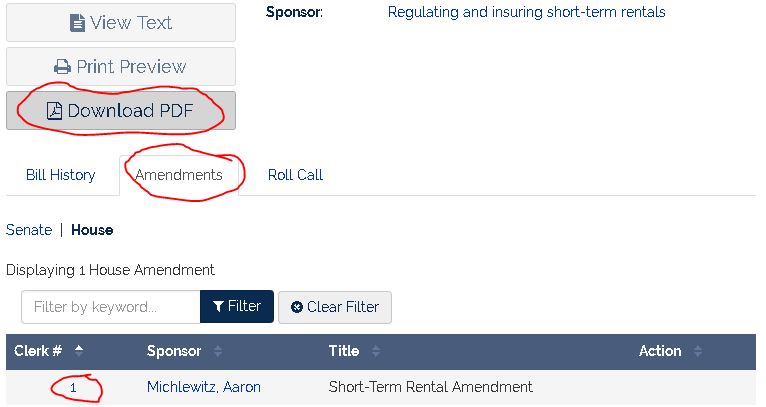

A PDF version of House Bill 4841 can be downloaded from this website: https://malegislature.gov/Bills/190/H4841/BillHistory

In addition to downloading the pdf of the original bill, it’s necessary to click on “Amendments” first and then click the “1” to the left of “Michlewitz, Aaron” (displayed below) in order to view the recent amendments:

The bill has already been sent to Governor Baker, who will have 10 days to review the final redraft and decide whether to sign this new version. It is believed that he WILL sign it.

We will keep you posted as developments occur, but please refrain from contacting us directly to inquire about this issue.