The Impact of the Lodging Tax on the 2019 Cape and Islands Rental Season

As of this writing, we’re just past the end of the 2019 summer vacation rental season on Cape Cod and the Islands. How are things looking? It seems to depend on who you ask. But if your bookings were off this year, it’s likely due to the new lodging tax.

Although bookings this year are off from last year, 2018 was an exceptionally strong year, the strongest on our site since 2013. And despite the turmoil caused by the new tax, most homeowners are booking their homes and adapting to the new reality. This is not to say that all homeowners have been unaffected by the tax, however, and there is ample evidence that those who did struggle this year believe the tax, not sharks or larger inventory, is to blame.

Breaking News: NJ exempts direct bookings!

Fellow vacation rental homeowners on the New Jersey Shore fought back against the negative impact of their new lodging tax, and won! Legislation JUST passed in New Jersey to grant exemptions from their newly minted, short-term rental tax to homeowners advertising on marketing sites like ours, which allow for direct booking between homeowners and their guests. Rentals processed through booking sites like Airbnb, HomeAway, and VRBO, however, will still be taxed. Read the full article here, and stay tuned as we learn more.

A look at 2019’s numbers

Overall, bookings on our site are down 2.2% from 2018. This includes all regions (Cape Cod, Martha’s Vineyard, and Nantucket) as well as all 3 seasons (spring/summer/fall). But for the summer (the lion’s share of a homeowner’s revenue) alone, bookings are off 3.5% (spring bookings were actually up 4.3% and fall so far are up 0.7%).

In general, inquiries (not bookings) in July were UP 4% from last year, and the volume of vacationers using our site was the strongest this July since 2012. We believe this is due in part to the fact that cost-conscious vacationers were particularly incented to find a reduced rate rental at the last-minute this year due to the added tax. Vacationers are savvy shoppers and realize they can book directly with homeowners on WeNeedaVacation.com and thus avoid the 5-20% booking fees that major sites like Airbnb, HomeAway and VRBO charge.

Sharks vs. Lodging Tax: Debunking some common theories

Despite claims in the press to the contrary, here’s what we DON’T think has had a negative effect on rentals this season:

- Sharks: The fact is, sharks aren’t affecting the number of vacationers – they are just affecting HOW we vacation. Outer Cape beaches and others are filled! But beachgoers are exercising the necessary caution to avoid swimming in deep waters. Given the booking numbers, particularly on the Outer Cape versus the rest of the C&I region, we feel that the shark situation has had very little impact on bookings.

- Inventory: The number of short-term vacation rental homes has risen steadily, but gradually, for the past 15-20 years, not overnight from last year to this. In fact, after reaching the highest number of homes on our site last year, our inventory actually decreased this year. Note: Of all of the reasons homeowners have given us for not renewing their subscriptions this year, the lodging tax was the most common reason (17%). Also significant are those who said they are no longer renting (14%) and those who are selling their home (9%).

What we DO think might have had a negative effect on rentals this season: the 9.7%-14.45% lodging tax.

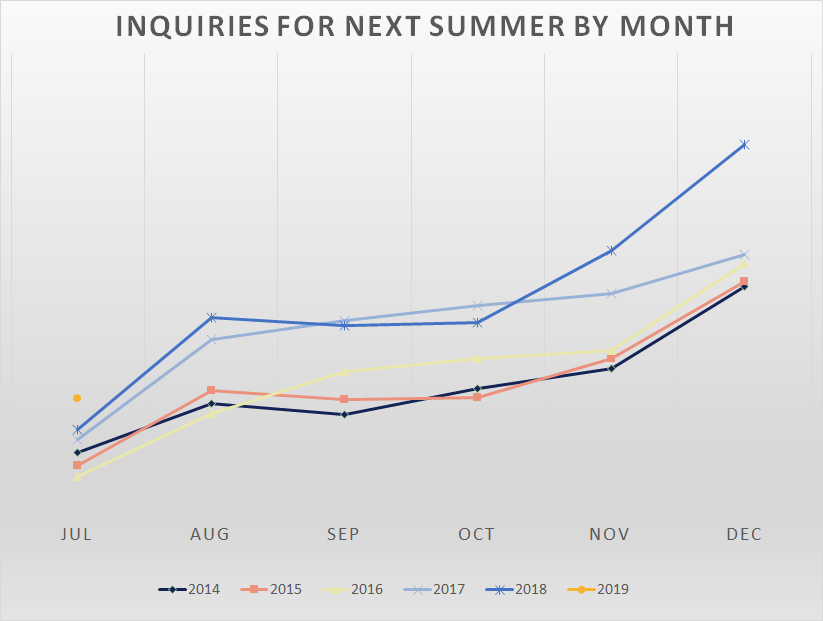

- There’s little doubt that our unprecedented, extraordinarily high inquiry numbers last December (up 44% over December 2017) should be attributed to the impending tax (effective as of 1/1/19).

- While summer bookings are off 3.5%, spring rentals, which were exempt from the tax, were up as much as 4.3%.

- The feedback we’ve heard from our hundreds of homeowners specifically blames the lodging tax for lost bookings from either past guests or new prospects.

Lately, sharks and the inventory of rental homes are being cited by those who lobbied for the tax as being responsible for the lower bookings. The “click bait” of the sharks, in particular, has simply provided them with a great opportunity to divert attention from the real culprit: the tax.

Drawing some early conclusions

Although overall booking numbers are not significantly down on our site, there’s no doubt that the new tax has created considerable upheaval for you, the homeowners, and for vacationers as well. A Hyannis homeowner, for example, who has listed with us for many years, told us,

“This year as many as 6 repeats said they couldn’t return because of the tax.”

– Hyannis Homeowner

And the press lately has indicated that tourism is definitely off this season.

For many of you, though, this year was just as good as years past. A homeowner who lists three properties in New Seabury told us,

“Our rentals are about the same as last year at this point. We have not lowered our price and have not had anyone comment either way on the lodging tax issue.”

– New Seabury Homeowner

Vacationers may have scaled back their choice of rental homes to less expensive options or waited until the last minute to book their rentals. And, in some cases, you have reduced your rates to mitigate the tax, or have even agreed to pay the tax.

Keep in mind that Massachusetts is the last state in the Northeast to impose a lodging tax on short-term rentals, although most nearby states’ rates are not as high:

| State | Tax Percentage |

|---|---|

| Vermont | 9% |

| Maine | 9% |

| New Hampshire | 9% |

| Rhode Island | 8% |

| Connecticut | 15% |

| Pennsylvania | 6% |

| New Jersey | 11.62% * |

* (Now only applicable to rentals booked via online booking sites such as Airbnb, HomeAway, and VRBO.)

What’s in store for the 2020 season?

Despite the fact that there will be no exemptions from the tax as there were this year (if leases were signed prior to 1/1/19 or for rentals prior to July 1st), the trend continues wherein early planners are starting earlier than ever. Perhaps this indicates a proclivity for discerning vacationers to get the right home at the right price.

What should homeowners do to succeed going forward?

Get started NOW for 2020! Given the growing trend over the past few years towards earlier bookings:

- Enter your pricing and availability for next season.

- Contact your 2019 guests and request a commitment from them earlier than usual.

- Offer incentives to past guests if they commit early for next year.

- Take fresh, new pictures while the grass is green and there are leaves on the trees.

- Consider offering as many amenities as possible including air conditioning, online payment options, and flexible dates (in the shoulder seasons).

- Set up a free Owner Special to promote a special offer or incentive to book by a certain date.

There’s a lot of competition out there, but we’re ALL subject to the new lodging tax. Don’t let it prevent you from successfully renting your home.

Same here had 2 weeks that I had no activation for the first time in 10 years I’m wondering what will happen next year…

Our test of the new tax is coming up now. A majority of our guests return from year to year and therefore their 2019 summer and fall season rental agreements were in place well before the implementation date for the new tax. We are now offering 2020 to our current/returning guests in a preferred reservation period through September 30. At that time we accept new guests. Typically our guests reserve the next year within one to a few weeks of returning from a current year’s stay. We’ll take note of any changes in guest behavior. We have had new inquiries for 2020. Unfortunately our policy of providing a courtesy rental period for current guests prevents us from offering new guests a stay at this time, but it’s a good sign – we’d like to believe – of a strong 2020 season.

Yes, let’s hope so! Many homeowners on our site haven’t even entered their pricing and availability for next year, and they may miss out on this wave of inquiries. There’s no telling when the wave will stop. I’m glad to hear that your “preferred reservation period” doesn’t go any later than September 30. Many homeowners are overly generous with the amount of time they give their returning guests – and they miss out on valuable early bookings from others in the process.

Hi Joan,

Thanks for keeping us informed. Yes, I’m sure the new tax has had a detrimental effect on our rentals. I had a week open in July even with adding central air. First time I didn’t fill the entire summer in renting for 8 years. Unfortunately the shark attacks didn’t help. I try to get your site advertised as much as possible. Keep up the good work.

Thanks so much, Jerry. We really appreciate your promoting our site when you can. We’re all in this together, and by promoting our site, all of us will experience better booking success. Hopefully, next July, after this initial year of disruption is behind us, you will be able to fill your home as you have before.

Elizabeth

Honestly, I don’t understand why no one is mentioning the impact of Airbnb and the fact that prices are falling all over the country but not on the Cape or Islands. I have friends who rent just a room and they charge half what I charge so are booked up right away. Another friend figured out that going to Hawaii for a week from Boston was going to be cheaper than renting on the Vineyard. I can’t afford to cut my price in half and I certainly can’t compete with Hawaii!

Excellent point, Julia! We can point our fingers at a number of factors (the tax, sharks, etc.) that undoubtedly have been deterrents this year from vacationers booking our homes. But you’re right that the fact is that vacationers have tons of other, less expensive options like Hawaii!

Elizabeth

Joan, Jeff, and team…can you provide an address or link where we homeowners can write to our state representatives OR petition a change in the tax framework? I know you have been active in the past, let me know how I can help or foster a (grassroots?) movement!

Hi, Anne, here’s a link to the 9 MA Representatives: https://www.govtrack.us/congress/members/MA#representatives. Unfortunately, despite all our efforts and those of may of our homeowners to prevent it, the bill has already passed. We are hoping that some person/group/entity will step up to spearhead a movement to at least modify the current bill. The moment we get wind of something like that happening, we will both support it in any way we can and also share whatever we learn with all of our homeowners.

Elizabeth

WE ARE CONSIDERING SELLING OUR COTTAGE AFTER RENTING FOR THIRTY YEARS. WE ALSO KNOW WHO WE WILL VOTE AGAINST NEXT YEAR

Hi, Don, We’re very sorry to hear that you are considering selling your home, presumably due to the new tax. Although it’s been a very challenging thing to accept and deal with this first year, we’re confident that things will calm down by next year or the year after, and vacationers and homeowners alike will accept it as the new norm. Keep in mind that Mass. is the last state in the Northeast to require a lodging tax on short-term rentals, and only around 6 other states don’t. But it’s a personal decision, and we wish you the very best whatever you decide to do.

Elizabeth

Thanks for the helpful updates. Since the hefty new tax hits many in-state residents, voters are likely to willingly and enthusiastically support a NJ style movement. (Having rented for many years, I estimate that roughly 2/3rds of my renters have been Massachusetts residents.)

Back in 2010, MA liquor dealers and their customers joined forces to repeal a new 6.25% sales tax on alcoholic beverages. The new short-term rental tax is twice as onerous.

I’m seriously considering selling my house as I don’t need the headache of having to write yet another check to the Commonwealth of Massachusetts. 🤬. I’m not a business or a major corporation. I’m just the little guy trying to make a few bucks so I can keep the house. I used to like Charlie Baker but not any more.☹️

For the first time in five years we were unable to find a tenant for the two weeks we rent out our Woods Hole house in August. We had two inquiries, but they were just fishing sorts of efforts. We are actually exempt from the new tax regime because we rent for no more than 14 days in the short term rental period over the summer – but still there was no real interest and no tenants. I feel strongly that the new short-term rental tax had a negative impact on us.

Dave Tucker

Would it be possible to offer us the Inventory and subscription statistics for the past couple of years as a comparison? How many people typically don’t renew and what are the reasons/percentages? Obviously, tax wasn’t a reason in past years, but selling their home or deciding not to rent stats would be helpful.

Every year some homeowners make the decision to no longer rent or to sell their homes. Often these homeowners have been renting for many years, and the time has come. This year, however, the number has increased, undoubtedly because they were on the fence anyway, and the additional burden of the tax tipped the scales earlier than they might have otherwise. As we noted in our article, the three most common reasons for homeowners not renewing were the lodging tax (17%), no longer renting (14%), and selling their home (9%). The latter two are up over the last several years.

As usual, WeNeedaVacation is proving valuable insight and information to us homeowners. Thank you so much. I’d love to see Massachusetts eliminate the short term lodging tax on directly booked rentals such as via WeNeedaVacation, as you reported NJ having successfully accomplished. What can we do to foster this?

Hi Joan I am just curious as how you compute your bookings numbers as We Need A Vacation is a listing service and does not actually book reservations. We are a Cape Cod Rental company that does book reservations and we have spoken to many rental company owners, private owners and local business owners and the feedback we are getting is that business is down 20+ percent. We have private owners calling us everyday to ask us to take over the rental and management of their homes as it has all become too complicated. And many owners are just throwing the towel in and putting their homes up for sale. Feel free to contact myself and co-owner Sonnie Hall anytime to discuss…We can all help improve this for our Cape Cod Rental owners and business owners.

Joanne, we’d be happy to speak with you and Sonnie and discuss our findings and the complexities of the overall rental market. We will call you soon. Thanks for reaching out.

Due to issues relating to the short-term lodging tax, I do not intend to rent our cottage anymore, unless Massachusetts follows New Jersey’s lead.

We’re sorry to hear that Susanna! You have been a loyal client since January of 2003, and we hate to see hardworking, responsible homeowners like you stop renting your home.

You have options to forward this article by Facebook, Twitter,etc. Why not by email as well? We aren’t all Millennials.

Hi, Ted. This blog post was just published this morning and is scheduled to be promoted on social media as well as by email shortly. In this case, you would have received a link to it by email (via our August Newsletter). But you can also subscribe to our Homeowner Blog so that you receive email notifications/links each time a blog post is published.

Unfortunately our local legislators turned their back on the small homeowner who rents their property short term.

They used a feel good proposal for environmental concerns , issues that government should be paying for any way. Remember those names on Election Day.

Well said, Vin!!!

Hi Joan,

We’ve been advertising with you for the last decade. We’ve never had so little interest as this past summer….perhaps 3-4 inquiries in total. Fortunately last November we were approached by an entity that wanted several weeks and we committed to that. But really really quiet and we don’t understand why. I called a couple of months ago and was told your folks would try to promote us, but only 1 call since then. We think we’re competitively priced. Neighbors in our area also had challenges. I wonder if bookings were down further than 3% in certain areas. Can you break this down further? Thanks, Marthe

My sister and I both own homes in Wellfleet which we rent, and, a first for both of us, we each had an open week during high season. I wonder if the effects will be more fully felt NEXT season, since this year I was able to write contracts for a number of my repeat tenants before January 1, as I’m sure many other homeowners did. Maybe we need to start a repeal movement like New Jersey’s!

We’re all for it, Susan! Unfortunately, we just do not have the time or resources to spearhead the movement. But we’d certainly be happy to support it in any way we could.