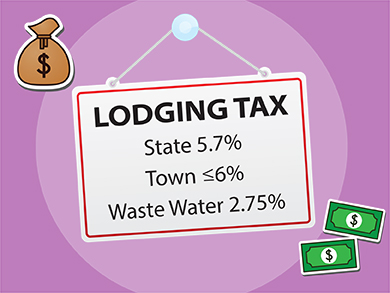

Many of you continue to have questions as you navigate the rules of the new MA short-term rental tax. Most of them can be answered by reading our Lodging Tax FAQ’s post, which we update regularly.

Remember that we post the tax percentage on each listing so that vacationers are aware of the tax before they even contact you.

Some homeowners have asked if they should reduce their rent to compensate for the tax. If you feel that it’s necessary for you to do so in order to fill vacancies, that’s fine. But we strongly discourage homeowners from incorporating the tax in the rental rates posted on their listings.

Getting used to the new tax and regulations this first year will be challenging for homeowners and vacationers alike. But keep in mind that, no matter which home vacationers choose, they will have to pay this tax. Additionally, all of the other New England states, along with many other states, have imposed this tax. It will take time, but eventually vacationers will realize the inevitability of a rental tax.

Recently, Joan Talmadge and Tyler Pyburn discussed some of the most common questions pertaining to the tax.

Thank you Joan – and Tyler – this is very informative.

Thank you for doing so much research throughout this whole process and continuing to keep us informed. You have been and continue to be immensely helpful. We appreciate it very much.

Thank you for the kind words, Ann and Vinny. We feel that it’s part of our job to keep you informed about such topics as the lodging tax. Joan

This is a horrible blow to us homeowners who choose to rent our homes to make owning such a second home feasible. I have read some articles claiming its the same tax imposed on a hotel. That is an unfair analogy. Hotels offer many services and have multiple opportunities other than rent to make additional money from renters such as room service, valet parking, meals/restaurants, cocktails,mini-bars, etc. We homeowners have one opportunity for income, the rent. And profit margins are not such that we are socking away all the profits, more likely we do not even cover our mortgages. And 14.45%!!! Seriously???

Ed, your reaction to the hefty tax is similar to that of many Cape and Island homeowners, and we share your concerns. Taxes on short-term rentals is becoming commonplace in the U.S., however. All of the other New England states now impose this tax, although only Connecticut’s is as high as the Cape’s. There’s no doubt there will be a real adjustment period, but we certainly hope it won’t deter vacationers from coming here. Joan

I think u are putting too much effort and focus on the new tax. Your focus should be promoting rentals on the Caoe. Thats why I pay to list on ur site. I especially dont like that you advertise the new tax on our listings. Having worked in marketing myself, this is a negative for potential renters. Airbnb or Homeaway doesnt do this. When u buy online or visit a store or restaurant , is that the first thing you are told , that there is a tax on the items u are purchasing. In my opinion, you do us a disservice by boldly putting the 14.5 percent tax on each listing. Its a very poor advertising and promotion on ur part. I think you overstepped boundaries by putting this on each listing . Atleast u could have said ‘subject to local taxes’ and leave out the 14.5 percent. Take off your Tax consultant hat and put on your Rental Promoter Hat.

I agree with that…..it should be changed to subject to local taxes…. and leave it be. Not to mention not all towns charge the same which now puts us in competition not only home to home but town to town…

I’m sorry that you feel that way, Mary. The vast majority of our homeowners are very grateful that we spell out exactly how much the tax is for each listing. Otherwise, it’s up to THEM to have to be the bearers of the ill tidings. Although every other state in the Northeast charges a lodging tax, ours in MA is considerably higher than every state except for CT. And don’t worry, the majority of towns on the Cape either started at 6% or have recently increased their rate to 6%, and we wouldn’t be surprised if the few remaining at 4% don’t raise their rates as well.

Love your site – love the fact that I have switched to it – but please please get an app for I phones – it will make life easier – getting a notice on text and then an app to see it that week is available , back to text and in 30 seconds a new rental

Hi, Barbara, we have no immediate plans to create an app. We have, however, ensured that the ability for a homeowner to view and respond to inquiries can be done efficiently thru a responsive mobile design. You should be able to click on the link in the text message to view the inquiry details and your availability calendar, and then respond to the inquiry directly from that web page.

Sadly as a non-resident of Mass. I don’t get a vote on the subject, As stated to “our” representatives without success in opposition to the bill:

We pay Mass. income tax on the net income from our rentals

We pay property tax although we have no children in the school system… nor did nor ever will as it’s a summer home.

We pay property tax on the full assessed value rather than the reduced amount paid by local citizens.

We pay personal property tax on the contents of the house.

We have in the past contributed to local charities that only benefit the local citizens.

Although the tax will be paid by the renters… and Joan’s comment about training the renters to accept the tax is well thought out… this will probably cost us a rental or two and will definitely impact our ability to raise rents on the future returnees. In short, I don’t think this is a fair tax and particularly not at the imposed level

We agree wholeheartedly with you, Larry. But at this point, the Lodging Tax is here to stay, and we all have to do the best we can to accept it and do what we can to market and manage our homes successfully.

This was very helpful. Just crazy how fast this all happened. Luckily, all but 2 renters were able to get leases signed by 1/1 and give us some payment. For the other 2, I have explained that the tax amount in West Tisbury is undetermined at this point. Luckily, we are all booked for “high season”.

Good for you, Kathy! Unfortunately, no one will be able to escape the tax next year though (unless the home is rented for 14 days or fewer or for stays of greater than 31 days).

I get questions about what the rent is with every single booking. And usually they have no idea what it is and are surprised when I tell them. So I doubt that they will realize the tax is additional. And I also think no one looks at the pricing grid or knows to go to the calendar with the pricing, which makes me think the link to it isn’t prominent and/or descriptive enough.

Thank you for your podcast.

You did begin to flesh out more of the ins/outs of what taxing my

rental customers involve.

Sadly, I will “comply” with all of this, but I remain adamant in my

position that I truly believe the State has no right to impose itself

this way and that I have the right to do with my property what I

want, including earning income from it if that is my choice.

Thank you.

Typical insatiable government money grab. I admire your fortitude but I wont play along with it…I am just a regular struggling middle class person who was interested in renting out my place for a very short season (really 4-5 weeks) to defray costs. Simply not interested in “partnering” with government at this point. Charlie Baker— a complete disappointment!!