As the new year (and decade!) has arrived, many vacation rental homeowners are assessing their marketing strategy for the next rental season. Naturally, they’re also anxiously awaiting the impact of the short-term lodging tax on this first full rental year of implementation.

The key question homeowners have expressed is whether the lodging tax will drive vacationers to go elsewhere for their summer vacation.

Our take is that vacationers will continue to get back to the Cape & Islands as they have done for generations – and the strong inquiries and bookings reported so far are driving our optimism.

2019 Wrap Up

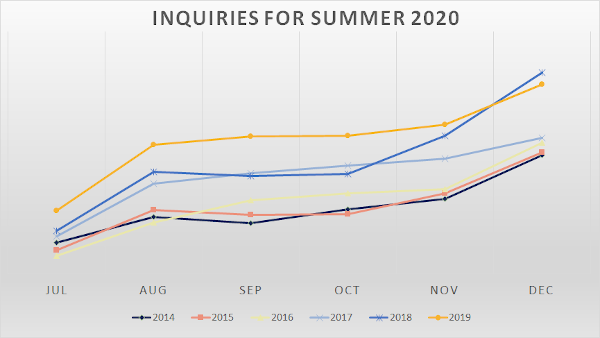

We’ve been observing a growing trend over the past few years for a higher volume of inquiries for the following summer occurring during the fall months through December. This year ended no differently.

Increases were seen every month, including large increases in both November and December, compared to previous years. The only difference, as expected, was a slight decrease in December this year. This was due to the announcement of the lodging tax on December 28, 2018, when many vacationers raced to book during the exemption period.

Overall, at the close of 2019, inquiries for the year were only 1% below the 2018 season.

Inquiries for Summer 2020 made during Fall 2019

Repeat Guests

We all know the value of a repeat guest – they are familiar with your home and are most likely to take good care of it and leave positive reviews. Repeat guests also allow a homeowner to fill up some weeks early in the season, reducing the number of new guests that are needed.

So, with the increase cost of the tax to a repeat guest who was exempt from the tax last year, what are you willing to do to keep that guest? Especially if the repeat guest stays with you outside of the peak summer season, you may want to consider adding an incentive. This could be anything from reducing the rate by a percentage to mitigate the tax, reducing the rate if the booking is confirmed by a certain date, or offering any other perks such as arrival or departure flexibility, linens, etc.

Will some guests still balk at the tax? Of course! But your goal, as it is every year, is to retain as many of these repeat guests as possible. (Read more about reaching out to past guests.)

Hopefully, many of you have already reached out to your past tenants, but if not, the time to do so is now!

Are people vacationing elsewhere?

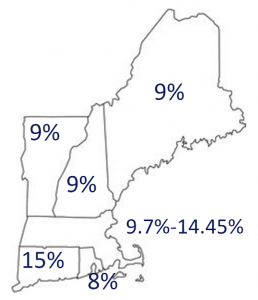

There’s a common misconception that people will decide to vacation somewhere else because of the tax. But remember that short-term rental taxes are new to Massachusetts but not to the US. In fact, Massachusetts was actually the last state in New England to adopt a short-term lodging tax.

Short term lodging tax by New England state

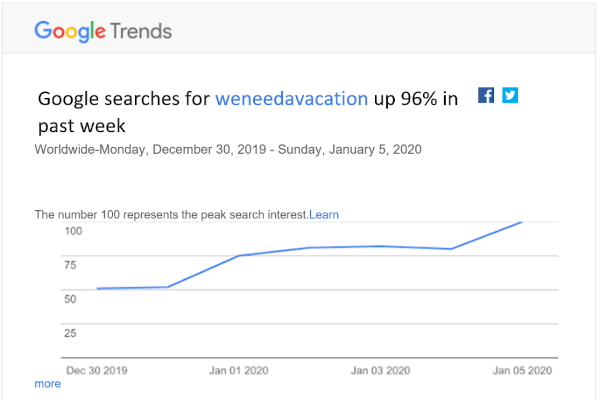

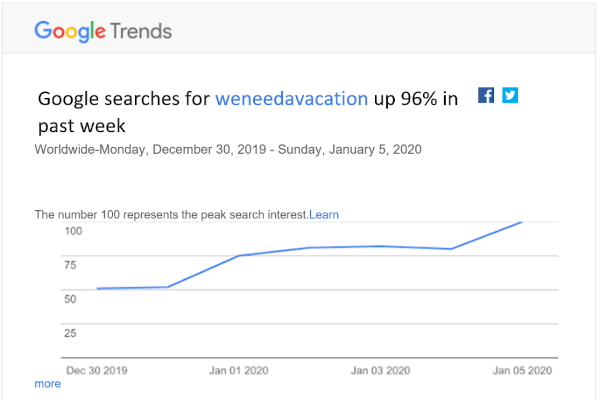

While we have observed the strong growth in inquiries in the fall, all eyes now turn to the activity after the holidays. Like clockwork, every year after Christmas, there is a noticeable increase in traffic and inquiries (both seeing an increase of over 200%).

Here’s what Google Search Trends is reporting over the past week for both direct searches to our website and for Cape Cod rentals. And similar Google Search Trend reports were seen for Martha’s Vineyard and Nantucket rentals earlier in December.

Google search trends for “weneedavacation”

Google search trends for “cape cod rentals”

Expectations for 2020

One of our favorite quotes:

We hear this type of comment all the time from users of our platform and on social media. The family vacation, family reunion, or weekend getaway are all types of traditions that people have established and want to ensure continue every summer.

With traffic trends pointing in the right direction and inquiries and bookings on par with prior years to kick off the new year, signs point to a strong interest in travel to the Cape & Islands. We will continue to monitor these trends and do everything we can to steer vacationers towards your rentals.

Weneedavacation kept us apprised of the impending tax. It was slipped in between Christmas and New Year’s.

Joan and I compared notes and I repeatedly warned people on my house rental Facebook page. We all called and wrote our representatives (mine assured me it was highly unlikely it would pass) The Governor had made it explicitly clear that he did not want this tax on homeowners. He was quite sensitive to the fact that many elderly and low income owners rely on short term summer rentals to survive. Thus he resisted it in previous years for any owners renting less than the summer or around 10 weeks. (His #s changed because he was losing traction.)

It was a battle between Airbnb and all short term rentals both owners and agents and the HOTEL LOBBY. The idea that this was a government tax grab is naive if you’re used to back room deals. So how do you sugar-coat it and try to get the little guys like us to embrace the tax? You promise “this that and the other” green or not. You offer communities the illusion of control by allowing them to add on to the base tax

This created a tax rate of 14.45% in Provincetown. They lured us with the idea that we could use the added tax for various.

The ultimate fact is that it wasn’t government it was the hotel Industry watching short term rentals eat up their profits. How to fight back? First you let towns ban or require complex sign ups. You talk about loss of housing (true but not exactly a tax)

I’ll assume that you read and followed Joan’s pleas to be heard. She gave detailed information and arguments to use to stop this tax. If you read through the infinite posts here you will see the work and passion put into this. I’ll also assume that you alerted your repeat renters, friends, gosh people on the street to advocate for us all. It was work and it was depressing to see it passed while almost NO legislators were around.

It’s big business as usual. If you’ve decided ahead of time that your voice doesn’t count at least research the economics behind this tax.

The irony here is blaming big government and “eco-freaks” when it was just good old Capitalism and backroom deals.

Thanks for the info and article. Unfortunately, the eyeball test and homeowner chatter is not as rosy as you suggest. I’ve owned in Eastham since 2013. We typically rent 11 weeks and on average have 25% rented by Jan. 1st and 75% rented by March 1st. As of this posting we have one week rented. I realize there may be many factors but the obvious difference this season is clearly the tax.

Hi, Jamie. I’m sorry that you’re not having the same early booking success as you’re used to seeing. But, you’re right – there could be a number of variables in play, one of which could be the tax. While we are hearing from some owners that their bookings are down, others are saying that they are having a particularly strong booking season so far. Your listing looks great, and you have terrific reviews, so I have every reason to believe that you’ll end up booking the summer weeks. Happy to speak with you if you’d like to give me a call (781-239-1469). Joan

Great article, thank you. I would be curious not only on the inquiries of rental properties, but a YoY comparisons of actual bookings to weeks available which may be a more relevant metric of the impact as well as by rental cost. Is there greater price sensitivity by average weekly rental? Just curious if you have the data.

Thanks Michael! And good questions on a booking comparison and pricing year-over-year. We do take a deeper dive into both these metrics periodically and are planning to gather this data after a few more weeks of activity. We’ll report on these numbers in early February.

The dirty little secret is this tax is another money grab by MA, shrouded in some B.S. about environmental improvements. How many times does Joe Average homeowner have to pay for Gov’t waste. Terrible job by our local reps in my opinion.